Former Nigerian Vice President, Atiku Abubakar, denied claims suggesting he retains a stake in INTELS, an oil and gas logistics company he sold in 2020 for $100 million.

Responding to allegations linking him to the company, Abubakar labeled the insinuations as mischievous, asserting that his divestment from the company is irreversible.

Join our WhatsApp ChannelSpeaking on the matter, Abubakar stated, “In January 2021, I made public the sale of my shares in Integrated Logistic Services Nigeria Limited (Intels) to Orlean Investment Group, the parent company of Intels. My divestment from the company that I co-founded has not been reversed.”

READ ALSO: Supreme Court Didn’t Rule On Obi’s Case Against Tinubu – LP Insists Petition Different From Atiku’s

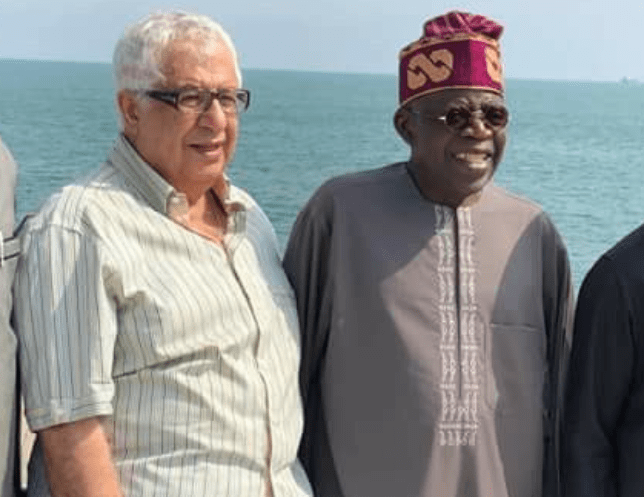

The ongoing controversy originated from an online post referencing a This Day publication, alleging Abubakar’s partial stake sale to the current President, Bola Tinubu, while maintaining a minority shareholder position.

Additionally, the report implied the reinstatement of the federal government’s agreement with INTELS under Tinubu’s leadership.

However, the Presidential Candidate in the 2023 election clarified that the phased sale of his shares started in 2018 and concluded in December 2020.

He emphasized that the ownership of the sold shares now belongs to a different entity, affirming his complete disassociation from any current benefits related to the company.

The history of discord between INTELS and the Nigerian government, particularly the Nigerian Ports Authority (NPA), began in October 2017 when the NPA terminated INTELS’ pilotage monitoring and supervision contract over alleged financial discrepancies. This led to a protracted disagreement resulting in the cancellation of the 17-year contract.

Abubakar’s divestment from INTELS came amid strained relations with the Nigerian government during the tenure of former President Buhari. The transaction, confirmed by an official at the logistics company, concluded in December 2020, marking the exit of Abubakar and his family from INTELS.

The former vice president’s direct response serves to clarify his non-involvement in INTELS and refute recent claims, emphasizing the completed and irreversible nature of his disinvestment from the company

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.