Oando, a prominent Nigerian oil producer, has announced its plans to acquire Italian energy giant Eni’s onshore Nigerian division.

This groundbreaking deal encompasses control over onshore upstream assets nestled in the heart of the Niger Delta, including a significant stake in the country’s Brass River oil terminal.

Join our WhatsApp ChannelThe acquisition centers on Eni’s Nigerian Agip Oil Company Ltd (NAOC), which currently holds operating interests in four Nigerian onshore blocks (OML 60, 61, 62, 63).

Additionally, NAOC boasts ownership of the Okpai 1 and 2 power plants, boasting a total nameplate capacity of 960 MW, and two onshore exploration leases. Operating in conjunction with the Nigerian National Petroleum Corporation (NNPC) and Oando as part of the NAOC Joint Venture, this deal will see Oando effectively doubling its stake in NAOC JV to 40%.

READ ALSO: Court Sets Date To Hear Oando’s Scheme Of Arrangement For Minority Shares

Oando‘s expansion doesn’t stop there. The assets under discussion encompass a treasure trove for the energy sector: 24 producing fields, 40 identified exploration prospects and leads, 12 production stations, 1,490 km of pipelines, three gas processing plants, and the prized Brass River oil terminal.

Notably, these onshore blocks produced approximately 24,000 barrels per day of oil equivalent, with a substantial portion of the gas reserves earmarked for supplying Nigeria’s NLNG liquefaction plant.

Although the financial specifics of the transaction remain undisclosed, Oando is set to nearly double its proven total oil and gas reserves, which stood at 503 million barrels of oil equivalent at the close of 2021.

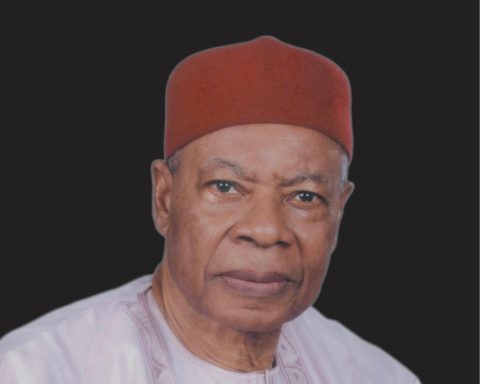

Wale Tinubu, CEO of Oando, expressed enthusiasm for the acquisition, stating, “The synergies created by this acquisition will unlock unparalleled opportunities for us to re-align expectations, enhance efficiency, optimize resource allocation, and significantly increase production. It is in alignment with our strategy of acquiring, enhancing, appraising, and efficiently developing reserves.”

In a strategic pivot, Eni has chosen to divest this significant portion of its Nigerian holdings. The Italian energy giant stated that this move aligns with its strategic plan to achieve an average 3%-4% growth in upstream output over the next three years, building on its 2022 production figure of 1.61 million barrels of oil equivalent per day.

The company’s official statement reads, “The upstream will supplement the core organically-led growth with inorganic high-grading activity, adding resources with incremental value while divesting resources that can offer greater value and opportunities to new owners.”

It’s worth noting that the deal excludes NAOC’s 5% participating interest in the Shell Production Development Company Joint Venture in Nigeria. After the transaction, Eni will maintain its presence in Nigeria through Nigerian Agip Exploration (NAE) and Agip Energy and Natural Resources (AENR).

The company will continue to focus on operated offshore activities in the country, while its non-operated stakes in other Nigerian assets, both onshore and offshore, as well as Nigeria LNG, remain unaffected by the sale.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.