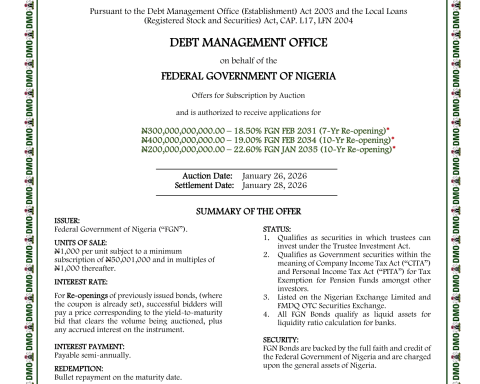

President Muhammadu Buhari disclosed that the Central Bank of Nigeria (CBN) will have to be paid N1.8 trillion if the National Assembly doesn’t restructure the N23.7 trillion loan obtained from the apex bank.

Buhari said the government is currently paying three per cent more than the 16.5 per cent interest rate offered by the central bank, as such, there’s a need to restructure the loan into bonds.

Join our WhatsApp ChannelHe explained that the central bank has agreed to accept nine per cent interest on the debt repayable in 40 years if the loan is transformed into bonds.

“I also urge the national assembly to reconsider its position on my proposal to securitise the federal government’s outstanding Ways and Means balance at the Central Bank of Nigeria (CBN),” Buhari said.

He added that, “As I stated, the balance has accumulated over several years and represents funding provided by the CBN as lender of last resort to the government to enable it to meet obligations to lenders, as well as cover budgetary shortfalls in projected revenues and/or borrowings.

“I have no intention to fetter the right of the national assembly to interrogate the composition of this balance, which can still be done even after granting the requested approval.

“Failure to grant the securitisation approval will however cost the government about N1.8 trillion in additional interest in 2023 given the differential between the applicable interest rates which is currently MPR plus three percent and the negotiated interest rate of nine percent and a 40-year repayment period on the securitised debt of the Ways and Means.”

Meanwhile, Prime Business Africa had reported earlier today that the Nigerian Senate has given Buhari conditions to meet for his request to be approved.

Recall that the Senate had last week turned down his request after an uproar in the upper chambers, with some lawmakers criticising the Federal Government for obtaining loans from the central bank without approval from the National Assembly.