By Mohammed I. TSAV Esq.

The implementation of these new tax laws in January 2026; under President Bola Ahmed Tinubu administration, in the midst of insecurity, endemic corruption and high inflation, an unsteady economy, and an unstable Naira, has sparked a debate regarding the negative effects the laws would have on the Nigerian economy, despite the intended goals of increasing revenue and improving the business environment.

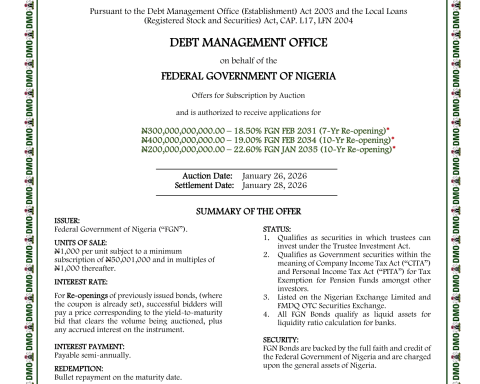

The five pieces of legislation that are slated to start on the 1st, day of January 2026 are:

Join our WhatsApp Channel1. Nigeria Tax Act 2026 [also called the Nigeria Tax (Fair Taxation) Law]; the core tax code that consolidates dozens of existing statutes.

2. Nigeria Tax Administration Act 2026; sets uniform rules for tax collection across federal, state and local levels of government.

3. Nigeria Revenue Service (Establishment) Act 2026; creates the new Nigeria Revenue Service [NRS] to replace the FIRS and gives it broader powers.

4. Joint Revenue Board (Establishment) Act 2026; establishes the Joint Revenue Board to coordinate tax policies among the three tiers of government and introduces a Tax Ombudsman.

5. Nigeria Tax Bill [Ease of Doing Business] 2026; the umbrella reform package that introduced the above four Acts and the shift to a more digital, transparent tax system.

These five statutes together form the “2026 tax reforms” that will reshape Nigeria’s fiscal and Tax terrain. The proponents of the new Tax regimes; argue that the reforms aim to simplify tax collection in order to streamline tax processes and reduce bureaucracy. It is alleged that it would relieve low-income earners, and exempt individuals earning below FRN=N=800,000.00K; annually from income tax. It would support small businesses by exempting small businesses from income tax, thereby promoting economic growth. Ultimately, the impact of PBAT’s tax laws depends on effective implementation and addressing corruption concerns.

However, others question the timing, citing pressing issues like security concerns, corruption, economic instability, food scarcity, and high inflation. They argue that these challenges should take priority, as increasing taxes could further burden citizens, small/medium businesses and exacerbate economic hardship.

Enacting tax laws in Nigeria at this time is a touching issue with differing opinions. Some argue that tax reforms are necessary to boost revenue generation, improve economic stability, and enhance the business environment. The newly signed tax laws aim to simplify the tax system, reduce multiple-taxation, and increase transparency.

President Tinubu’s administration has emphasized that the reforms will promote economic growth, attract investments, and support development. The laws include measures to exempt small businesses, reduce corporate tax rates, and introduce VAT exemptions for essential goods.

All been said, one is tempted to ask; Are the new tax Laws a written script by the Tax Inspectors without Borders; [TIWB] being implemented by the PBAT administration? The TIWB, is a joint initiative of the Organisation for Economic Co-operation and Development [OECD], and the United Nations Development Programmed [UNDP], launched in July 2015. Its primary goal is allegedly to support developing countries in building their tax audit capacity and addressing critical taxation challenges. TIWB aims to enhance domestic resource mobilization and tackle illicit flows, thereby contributing to the financing of the Sustainable Developing Goals; [SDG]. Again one is tempted to ask, is it contributing to or is it financing the SDG formulated by the western world for their benefit and in their interest?

READ ALSO : BLAKEY Unveils Strengthened Speaker Roster as Nigeria Nears 2026 Tax Overhaul

Tinubu Approves National Committee to Drive Implementation of New Tax Laws

Governments rarely introduce new tax laws just for the sake of it; they usually do so to solve a specific problem or problems that the old laws can no longer handle. Generally, these laws usually fall into four main categories as follows; funding public needs, steering human behaviour, fixing economic gaps, and modernizing outdated systems.

1. Revenue Generation [Funding the State]: This is the most direct reason, that the government needs money to function. Old tax laws often fail to generate enough revenue as the economy changes. Revenue generation is the most obvious motive. Taxes fund everything from schools, hospitals, markets to roads and defense, keeping the state running and delivering public services .

i. Infrastructure & Services: New taxes fund modern necessities like high-speed rail, digital infrastructure, healthcare, and defense.

ii. Or permanent levies to pay down national debt.

iii. Expanding the Tax Base: Governments try to capture revenue from sectors that didn’t exist 20 years ago, such as the digital economy (e.g., taxes on streaming services or remote work platforms).

2. Behavioural Engineering [Steering Choices]: Governments use taxes as a tool to encourage or discourage specific actions by citizens and corporations. Behavioural nudges are taxes directed on tobacco, alcohol, carbon intensive goods or luxury items aim to discourage harmful or wasteful consumption while raising money at the same time .

i. Sin Taxes: These are designed to discourage harmful habits. Examples include increased taxes on tobacco, alcohol, and sugary drinks. The goal is to lower public health costs by reducing consumption.

ii. Green Taxes: To combat climate change, governments impose carbon taxes or levies on single-use plastics. This makes polluting expensive and forces companies to innovate greener solutions.

iii. Incentives: Conversely, negative taxes [tax credits/rebates] are introduced to encourage behaviour, such as buying electric vehicles or investing in renewable energy.

3. Social Equity [Redistribution]: New laws are often introduced to address widening gaps between the rich and the poor. Redistributing income by progressive taxes and targeted relief help narrow the gap between rich and poor, channelling resources toward welfare programs and social safety nets.

i. Progressive Taxation: Laws may be updated to ensure high earners pay a larger percentage. For example, introducing a wealth tax or increasing Capital Gains Tax [tax on profit from selling assets like stocks or property] targets those who make money from money, rather than labour.

ii. Relief for Lower Earners: New laws often exempt the lowest earners entirely to protect them from inflation. An example: Recent reforms in Nigeria [Finance Act/Nigeria Tax Act updates] aimed to exempt minimum wage earners from certain taxes while streamlining collection from wealthier corporations.

4. Modernization & Efficiency: Sometimes, the new law is just a clean-up of a messy old system. Economic steering by tweaking rates or creating new levies, a government can cool an overheating economy, curb inflation, or boost growth by lowering taxes on productive activities .

i. Simplification: If an old tax code is too complex, it breeds corruption and evasion. New laws often aim to consolidate multiple small taxes into one clear payment to make compliance easier for businesses.

ii. Closing Loopholes: Wealthy individuals and corporations find legal ways to avoid paying tax [avoidance]. Governments pass new laws to close these unintended gaps.

iii. Formalizing the Economy: In many developing nations, a huge chunk of the economy is informal [cash-based and untaxed]. New laws often try to bring these businesses into the formal fold by offering benefits in exchange for registration.

iv. Managing externalities by levying charges on pollution or resource depletion forces producers to internalize the social cost, encouraging greener practices .

v. Protecting domestic producers: by imposing import duties and special levies on foreign imported products it makes foreign goods pricier, shielding local industries and improving the balance of payments .

Governments introduce new tax laws for a handful of practical reasons. In short, new tax laws are a toolbox for governments; they raise the cash needed for public spending, shape economic behaviour, promote fairness, and protect national interests.

Whatever the reasons for these new tax regimes in Nigeria; ultimately, the effectiveness of these tax laws depends on implementation, addressing corruption, and ensuring the benefits reach the polity. Some experts suggest that addressing security, corruption, and economic stability should proceed or accompany tax reforms.

The new tax laws introduced by President Bola Ahmed Tinubu in Nigeria could have several negative effects on the average citizen, particularly in the context that Nigeria has not adopted a zero tolerance stance on corruption within the government.

In the present circumstances of the Nigerian economy; which is not stable, the imposition of new tax regimes may even negate the intentions of the taxes. There are key concerns and potential adverse effects that must be highlighted given the earning capacity of the average Nigerian. Here are some potential impacts:

1. Increased Financial Burden Increased Burden on Businesses and Individuals.

Increased tax rates will definitely lead to a greater financial burden on the average Nigerian, especially those already struggling with economic challenges. These higher taxes might discourage small and medium-sized enterprises [SMEs] from expanding, potentially stifling economic growth. Higher taxes can reduce the disposable income of families, affecting their ability to spend on essential amenities, goods and services.

2. Economic Inequality.

There would be issues of inequitable distribution arising: The benefits of tax reforms might not reach the intended recipients, exacerbating income inequality and a widening class gap. New tax laws that disproportionately affect lower and middle-income earners can exacerbate economic inequality, making it harder for these groups to improve their living standards. The gap between the upper class and the middle class will get wider and wider.

The new tax laws may translate into disincentives for small businesses. Increased taxation on small businesses can stifle entrepreneurship and limit job creation, further entrenching poverty. The compliance costs may not have been contemplated as businesses, particularly Small and Medium-sized Enterprises [SMEs] that are not fully exempted, navigating new tax laws and compliance requirements can be costly and complex, potentially leading to inefficiencies.

3. Corruption Concerns.

There will be issues relating to lack of transparency in the implementation of these new Tax regimes. The tax reforms might not address underlying issues of corruption and mismanagement of funds. It may even give room for mega fraudulent schemes. The Tax landscape will be a fertile ground for corruption.

There would be issues of misappropriation and misallocation of funds unaccounted for. With existing corruption among politicians, and government officials, there is a risk that tax revenues will not be used for public good, such as infrastructure or social services, but instead line the pockets of corrupt officials.

This will certainly erode trust and citizens may become disillusioned with the tax system if they perceive that their contributions are being misappropriated, leading to tax evasion and a lack of compliance. The new tax laws can inadvertently create opportunities for corruption in several ways:

i. Complex Regulations will definitely create the opportunities for corruption. Complex tax codes can lead to confusion and misinterpretation, creating loopholes that corrupt officials might exploit for personal gain. The impact of these new Tax regimes on Businesses and individuals may resort to bribery to navigate these complexities or avoid penalties.

ii. Discretionary Power of Tax officials will open up corrupt opportunities. If tax officials have significant discretion in enforcement or the granting of exemptions, it can lead to abuse, favouritism and corruption. Officials may demand bribes in exchange for favourable treatment or to overlook tax evasion.

iii. Weak Enforcement Mechanisms are a recipe for corruption. Inadequate oversight and enforcement can lead to increased opportunities for corrupt practices. Without robust accountability measures, officials may engage in corrupt activities without fear of repercussions.

iv. Revenue Generation Pressure will also create avenues for corruption. High pressure to meet revenue targets can lead officials to engage in corrupt practices to boost collections. This could include aggressive enforcement tactics or coercion of businesses to pay more than their fair share.

v. Ineffective Whistle-blower Protections is a corridor for corruption. A lack of protections for whistle-blowers can deter reporting of corruption. Employees may fear retaliation if they expose corrupt practices, allowing corruption to thrive unchallenged.

vi. Political Interference is the main highway for corruption in Nigeria. Political influence over tax administration can lead to corruption, especially if tax laws are used as tools for political gain. Favouritism in tax assessments or exemptions can undermine public trust and encourage further corruption.

vii. Inadequate Training and Resources shall most definitely encourage and breed corruption. Poorly trained tax officials may resort to corrupt practices out of desperation or lack of knowledge. Insufficient resources can lead to inefficiencies and increased reliance on bribery to facilitate tax processes.

4. Impact on Public and Social Services.

With the introduction of higher taxes most businesses and individual will most certainly seek ways to evade these taxes and some may even relocate their businesses to other jurisdictions. Higher taxes on goods and services might lead to increased prices, affecting low-income households.

There will a rise in the cost of living and inflation in the country. Even though some essential goods are zero-rated, any overall increase in tax rates or the introduction of new levies can contribute to a rise in the prices of goods and services, leading to higher inflation and reducing the purchasing power of ordinary Nigerians.

It would automatically discourage many Investors who may prefer to invest in tax heavens. Pessimists argue that massive taxation can act as a disincentive for companies and individuals with the capacity to invest in manufacturing and production. Faced with a heavy tax burden, businesses may scale down operations or halt new ventures, potentially leading to redundancies and unemployment. Growing discontent can challenge the legitimacy of the government’s projects, potentially leading to social unrest and further economic crisis which may trigger union activism and strikes that may shake the focus of leadership.

The Digital Services Taxes will affect online subscriptions and e-commerce could become more expensive, impacting Nigerians who rely on digital services. Again; if tax revenues are not effectively reinvested into public services due to corruption, citizens may experience deteriorating services such as health care, education, housing and infrastructure.

The combination of higher taxes and mismanagement of funds can lead to public dissatisfaction and protests, destabilizing the social fabric. Increased taxation without proper oversight could lead to cuts in social programs that are crucial for the vulnerable population.

5. Unforeseen Repercussions.

i. Macroeconomic Instability: A pursuit of a high tax-to-GDP ratio under the current economic circumstances; high inflation, etc., could cause unforeseen repercussions, especially when combined with other major reforms like the removal of petrol subsidies and the floatation of the naira, which have already led to macroeconomic instability and rising poverty.

ii. Risk of Misallocation: There is a concern that the large revenues generated from the tax drive might not be spent on industrial development, production, or public services, but could be used to fund a high cost of governance, compensating political allies, which invariably means the public suffers a double blow of high taxes and a lack of corresponding investment and services.

6. Exacerbation of Regional Disparities.

VAT Revenue-Sharing Formula: A contentious aspect of the reform is a proposed Value Added Tax [VAT] revenue-sharing formula that shifts the basis from the state where companies remit taxes [often in Lagos and Rivers] to one based more on consumption.

a. This has drawn strong criticism from some northern state governors and stakeholders who fear it will unfairly shift revenue to southern states and worsen existing economic disparities, disrupting the balance of fiscal federalism.

b. It also highlights a deeper issue of states’ over-reliance on federal allocations instead of actively developing their internal revenue generation capacities.

7. Impact on Capital Importation.

The new tax laws in Nigeria may negatively impact capital importation in several ways. There will be increased Tax Burden on businesses. The introduction of a 30% Capital Gains Tax [CGT] for corporate entities could discourage foreign investors, potentially reducing capital inflows.

The Top-up Tax will affect Multinational companies with effective tax rates below 15%, will be subject to a top-up tax, increasing their tax liability and potentially deterring foreign investment.

The Enhanced Documentation Requirements imposes stricter documentation requirements for international transactions, including proof of export proceeds repatriation, and will increase compliance costs for investors.

The new tax laws come with their complexity and uncertainty. The new tax regime’s complexity and potential for varying interpretations may create uncertainty, discouraging foreign investors.

The Repatriation Requirements imposes the mandatory repatriation of funds through authorized dealers, with required documentation, which may pose challenges for investors. In order to mitigate these risks, investors should:

i. Review Contracts: Ensure compliance with repatriation clauses and documentation requirements.

ii. Implement Compliance Systems: to track export proceeds and ensure proper documentation.

iii. Seek Professional Advice: to navigate complex tax and foreign exchange regulations.

iv. Restructure Offshore Arrangements: by aligning with the new tax regime.

It is important to note that the reforms also include provisions intended to mitigate negative impacts, such as exempting low-income earners e.g., those earning below FRN=N=800,000.00K; annually; and small businesses from certain taxes, and zero-rating VAT on essential items. The final impact will largely depend on the cohesiveness, transparency and efficiency of the implementation and the overall economic environment.

The truth in all these is that at this point in time in Nigeria’s development, when the country is in security crisis, the economy is not steady, the Nigerian Naira [=N=] is unstable, there are no jobs, the agricultural sector is in shambles, the security of lives and property is at the mercy of Bandits, Marauders and Herdsmen, the monumental corruption in public services, the issue of new tax laws is a misplaced priority. The tax sector will inevitably be a fertile environment for massive corrupt practices. This is not the time to enact new tax laws nor is it the time to tax the citizenry.

The timing of enacting tax laws in Nigeria, given the current challenges, raises several important considerations:

- Economic Context: With the economy struggling, high inflation, and currency instability, imposing new taxes could further burden citizens and businesses. It’s crucial to assess whether the economic conditions are conducive to additional taxation.

- Security Concerns: In a country facing security crises, resources may be better allocated to addressing safety and stability rather than focusing on tax legislation. Security issues can hinder economic growth and tax compliance.

- Corruption: Enacting new tax laws without addressing corruption may lead to ineffective implementation. Strengthening governance and accountability mechanisms should be a priority to ensure that tax revenues are used effectively.

- Food Security: With food scarcity, there may be a need for policies that promote agricultural productivity and support vulnerable populations rather than increasing tax burdens.

- Public Sentiment: The government’s credibility and legitimacy can be affected by public perception of its priorities. If citizens feel that tax laws are being enacted without addressing pressing issues, it could lead to discontent and resistance.

The grapevine, that Western Tax collectors packaged by the United Nations working under the name of Tax Inspectors Without Borders, who are forensic auditors on a mission in Africa to encourage African countries to introduce Tax regimes in their countries so as to collect tax from its citizens and service the interest of loans given to Africa countries by a Carrot and Stick Methodology, in that; the countries that comply are granted further loans and those that do not comply are treated as outcasts and are denied loans. If this is the case, then the PBAT administration has neither confirmed it nor denied it, but have gone ahead to enact new tax laws.

- Conclusion

In summary, while tax reform can be necessary for generating revenue for development, the potential negative effects on the average Nigerian, compounded by corruption, could lead to increased financial strain, economic inequality, and social unrest. It should ideally be part of a broader strategy that addresses the underlying issues currently affecting the country. Engaging with stakeholders and considering the socio-economic climate is essential for any proposed changes in tax laws to be effective and accepted.

Addressing these issues requires enforcement, transparency, accountability, and a commitment to use tax revenues effectively for the benefit of all citizens. Nonetheless, this is not the time to enact new tax laws nor is it the time to tax the citizenr

The government must mitigate the risks in the taxation sector, it is essential for the government to implement strong good governance frameworks, enhance transparency, and promote accountability in tax administration. This includes simplifying tax laws, ensuring adequate training for officials, and establishing strong institutions with robust mechanisms for reporting and addressing corruption.

Then again what has the Tax Inspectors without Borders got to do with these new tax laws in Nigeria? Has the Nigerian Government got something to disclosure to Nigerians? The ball is now in the court of the PBAT’s Administration.

Mohammed Tsav is the son of CP Abubakar Tsav (late). He wrote this as part of his contributions to the tax debate as Jan 1 commencement date approaches.