The dominance of Foreign Portfolio Investment (FPI) in Nigeria’s foreign inflows has raised significant concerns about sustainability and the long-term impact on the economy.

The recent report released by the National Bureau of Statistics (NBS) showed that FPI accounted for 92.25 per cent ($5.2 billion) of total capital importation in Q1 2025, while Foreign Direct Investment (FDI) represented only 2.24 per cent ($126.3 million).

Join our WhatsApp ChannelThe report showed that the total capital imported into the country rose quarter-on-quarter by 10.9 per cent to $5.64 billion in Q1 2025.

On a year-on-year basis, the report said total inflows surged by 67.1 per cent.

Analysts observed that FPI, also regarded as “hot money,” is highly volatile and sensitive to shifts in domestic monetary policy and global risk sentiment.

Data obtained from the Nigerian Exchange (NGX) revealed that FPI inflows surged to N1.81 trillion in July 2025, reflecting a 133.09 per cent jump from N778.65 billion in June 2025 and a year-on-year increase of 269.19 per cent compared to N491.61 billion recorded in July 2024. However, foreign inflows of N50.4 billion were surpassed by outflows of N95.4 billion.

This volatility, according to analysts, contrasts with FDI, which signifies long-term commitment but remains subdued due to structural issues like insecurity, weak institutions, and bureaucratic inefficiencies.

Meristem Research observed that the surge in foreign investment portfolio reflected renewed foreign appetite for Nigerian equities and fixed-income instruments due to improved macroeconomic reforms and attractive yields.

READ ALSO: More Confidence In Nigeria’s FX Market As FPI Inflows Rise By 134% In June

The firm said it also expects portfolio inflows to remain robust in the short term, driven by high domestic yields, foreign exchange reforms, and improving macroeconomic stability.”

Meristem, however, stated that FDI’s continued weakness, combined with the concentration of inflows in a small number of sectors and locations, highlights the need for more structural reforms to attract patient capital capable of supporting diversified, long-term growth.

While commenting on Nigeria’s foreign inflows, Afrinvest echoed concerns about the dominance of portfolio inflow over FDI, noting that it is being driven largely by activities in the money market, where Treasury Bills, Bonds, and OMO bills offered yields above 20 per cent.

The financial services firm also warned about the sensitivity of such inflows to shifts in domestic monetary policy, global risk sentiment, and macroeconomic shocks.

“While portfolio flows swelled, more stable and growth-oriented foreign direct investment (FDI) was subdued, rising just 6.0 per cent y/y to $126.3 million but contracting 70.1 per cent q/q, representing only 2.2 per cent of total inflows compared with 3.5 per cent a year earlier,” it stated.

READ ALSO: Nigeria’s FDI Drops 70% Despite Rise In Capital Importation

It attributed the weak performance of FDI to “low confidence in the long-term prospects of the economy amid the legacy issues of insecurity, weak institutions and enforcement of law, bureaucratic inefficiencies, and a high corruption perception.”

It also noted that the capital importation report revealed “a heavy skew towards financial services, with banking absorbing 55.4 per cent of inflows and financing 37.2 per cent, leaving manufacturing, telecommunications, and other sectors with a marginal share,” while geographically, Lagos and Abuja accounted for 99.7 per cent of total inflows, exacerbating regional disparities and limiting broad-based economic development.

This concentration contrasts with the need for diversified investments to support sectors that generate employment and value addition.

Macroeconomic Stability and Policy Constraints

The Central Bank of Nigeria (CBN) maintained a hawkish monetary policy (MPR at 27.5 per cent) in the last one year to attract FPI through high yields on money market instruments.

Economic experts have stated that while this policy has helped to stabilise the naira (trading between ₦1,500 and ₦1,600/$ as at H1 2025) and reduced FX volatility, it has, however, constrained private sector credit growth and economic expansion due to high borrowing costs.

The inflation rate, though on a downward trend, is still considered elevated at 21.88 percent as of July 2025, reflecting the impact on purchasing power.

Debt Sustainability Challenges

Nigeria’s total public debt reached N149.39 trillion in the first quarter of 2025, a 22.8 per cent year-on-year increase, with forecasts suggesting it could exceed N160 trillion by year-end due to continued borrowing and currency depreciation.

According to the Debt Management Organisation (DMO), external debt rose to N70.63 trillion ($45.98 billion) at the end of the first quarter of 2025.

While the debt service costs are alarmingly high, consuming over 50 per cent of government revenue, analysts cautioned that reliance on external borrowings (such as Eurobonds and multilateral loans) exposes Nigeria to currency risks, with interest costs on Eurobonds reaching roughly 9 per cent.

Achieving a Balanced Investment Framework

To foster resilient economic growth, experts believe that Nigeria must improve on measures to attract more foreign direct investments.

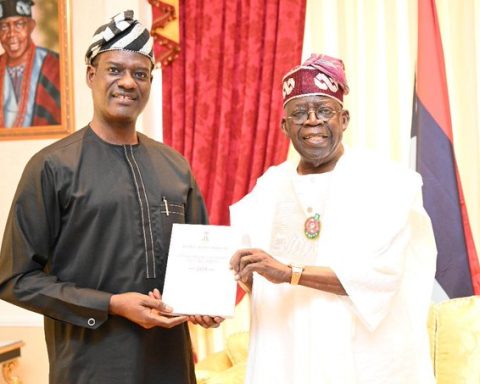

Former presidential candidate of the Labour Party, Mr Peter Obi, while commenting on Nigeria’s low FDI profile recently, said sustainable economic growth and development cannot be achieved under a deeply entrenched poor leadership and weak governance.

According to Obi, “We cannot achieve sustainable growth and development with ineffective leadership and a weak government.”

He called for better leadership that boosts investor confidence in the economy to attract long-term investments in Nigeria.