In its quest to meet the Central Bank of Nigeria’s new capital requirements, the United Bank for Africa (UBA) has declared its intention to raise N157.8 billion by means of a rights issue.

This was disclosed in a statement signed by the Head of Issuer Regulation Department at Nigerian Exchange Limited (NGX), Godstime Iwenekhai, released on Wednesday.

Join our WhatsApp ChannelIn the statement, NGX notified trading licence holders that UBA has applied for approval and listing of a rights issue of 3,156,869,665 ordinary shares of 50 kobo each at N50.00 per share through its stockbrokers, United Capital Securities Limited.

The statement reads: “Trading License Holders are hereby notified that United Bank for Africa Plc (the Company) has through its Stockbrokers, United Capital Securities Limited, submitted an application to Nigerian Exchange Limited for the approval and listing of a Rights Issue of Three Billion, One Hundred and Fifty-Six Million, Eight Hundred and Sixty-Nine Thousand, Six Hundred and Sixty-Five (3,156,869,665) ordinary shares of 50 Kobo each at N50.00 per share.”

The statement further said the qualification date for the Rights Issue is 16 July 2025.

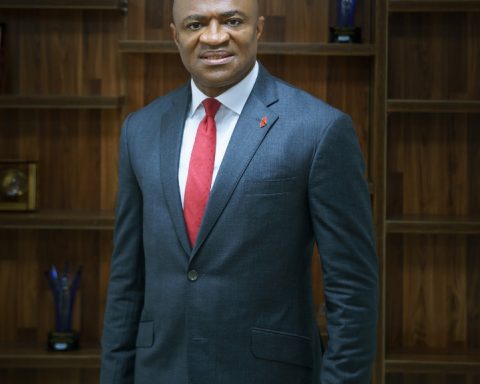

Prime Business Africa recalls that UBA Group Chairman, Tony Elumelu, had during the bank’s 63rd AGM in April, announced plans to embark on a second Rights Issue in the third quarter of 2025 to raise N249 billion, completing the N500 billion mandated by the CBN for bank recapitalisation.

Elumelu said the second Rights Issue would serve the best interests of existing shareholders, adding that the final phase of the capital raise would be completed ahead of the CBN’s March 2026 deadline.

READ ALSO: UBA Raises N355.2bn Of N500bn CBN’s Capital Requirement

Elumelu also disclosed that the earlier Rights Issue closed in December 2024 with 6.84 billion ordinary shares of 50 kobo each offered to existing shareholders at N35 per share.

The offering was oversubscribed by N11.6 billion, and the full amount of N251 billion raised has been verified and approved by the CBN.

This comes as the bank also reported a profit after tax (PAT) of N767 billion for the 2024 financial year.

UBA GMD, Oliver Alawuba, had said proceeds from the exercise will be directed towards investment in digital technologies and business expansion, strengthening UBA’s 75-year track record.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.