The Nigerian government has disclosed that the newly signed tax laws will take effect from 1st January 2026.

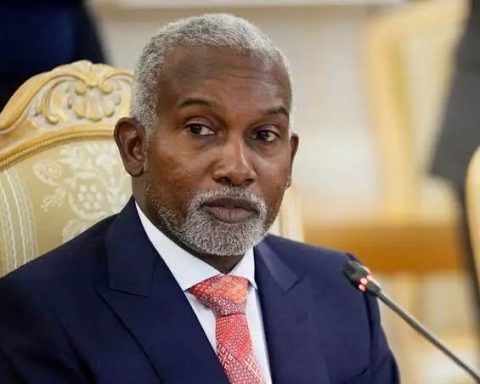

Chairman of the Nigeria Revenue Service (NRS) and special adviser to the President on Revenue, Zacch Adedeji, made this known while briefing State House correspondents shortly after the signing ceremony at the Presidential Villa, Abuja, on Thursday.

Join our WhatsApp ChannelPrime Business Africa reported that President Tinubu signed four landmark tax reform bills into law on Thursday. The laws are aimed at unifying Nigeria’s fragmented tax structure.

The new tax laws were intended to increase investor confidence, eliminate duplication, and make the system more transparent and equitable.

The President described the development as a “bold and foundational shift” in Nigeria’s fiscal policy direction.

The four bills signed into law include the Nigeria Tax Bill (Fair Taxation), Nigeria Tax Administration Bill, Nigeria Revenue Service (Establishment) Bill and the Joint Revenue Board (Establishment) Bill.

Adedeji stressed that the chosen date for commencing the implementation of the new tax laws was to pave the way for the necessary documentations and adjustments needed to effect the changes.

He noted that with the new tax laws, the Federal Inland Revenue Service (FIRS) has automatically transformed to the Nigeria Revenue Service (NRS).

“We were FIRS two hours ago, but with the assent of the Tax Reforms Bills by the President, we are now the Nigerian Revenue Service, which has expanded its scope to also focus on non-tax collection and increase efficiency,” Adedeji stated.

He added that the NRS has emerged as the implementer of all major taxes in the country.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.