In its quest to deepen commitment towards supporting women entrepreneurs, one of Nigeria’s leading financial institutions, Wema Bank, has revamped its 9 percent Loan package for Female SME owners.

The revamped offer includes a longer tenor, easier access and requires no guarantor or collateral, in accessing this facility. This is a boon for those wishing to restock their businesses for the festive season or other short-term business needs.

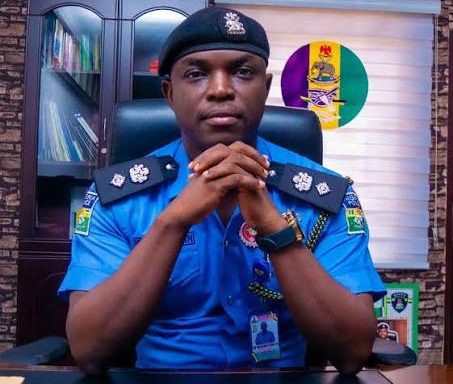

Divisional Head for Retail Business, Wema Bank Plc, Dotun Ifebogun said the bank management has reviewed the package to make it easier for loan applicants to access the facility which would help them grow their businesses.

Ifebogun said the Bank has shown its interest in the growth and development of female-owned businesses by also offering business training in the past through the Sara by Wema proposition, adding that the revamped loan offer is another effort in that direction as they will access business loans at a single-digit interest rate with insurance cover, among other benefits,” he said.

According to him, apart from requiring no collateral or guarantor, applicants can access a loan of up to N1 million with a one-year tenor instead of the previous six months, adding that people who do not have a Wema Bank account can also benefit by signing up on ALAT.

Highlighting other eligibility criteria, the Divisional Head, Retail Business, said to access the 9 per cent loan offer, the beneficiary business “must be owned or run by a woman while the company shareholding must show that women own at least 51% of the business or 2/3 of signatories are women.”

He also explained that the facility is available to register and unregistered women-owned businesses operating for a minimum of two years, as well as new loan customers with applicants enrolled on at least one of Wema Bank’s channels.