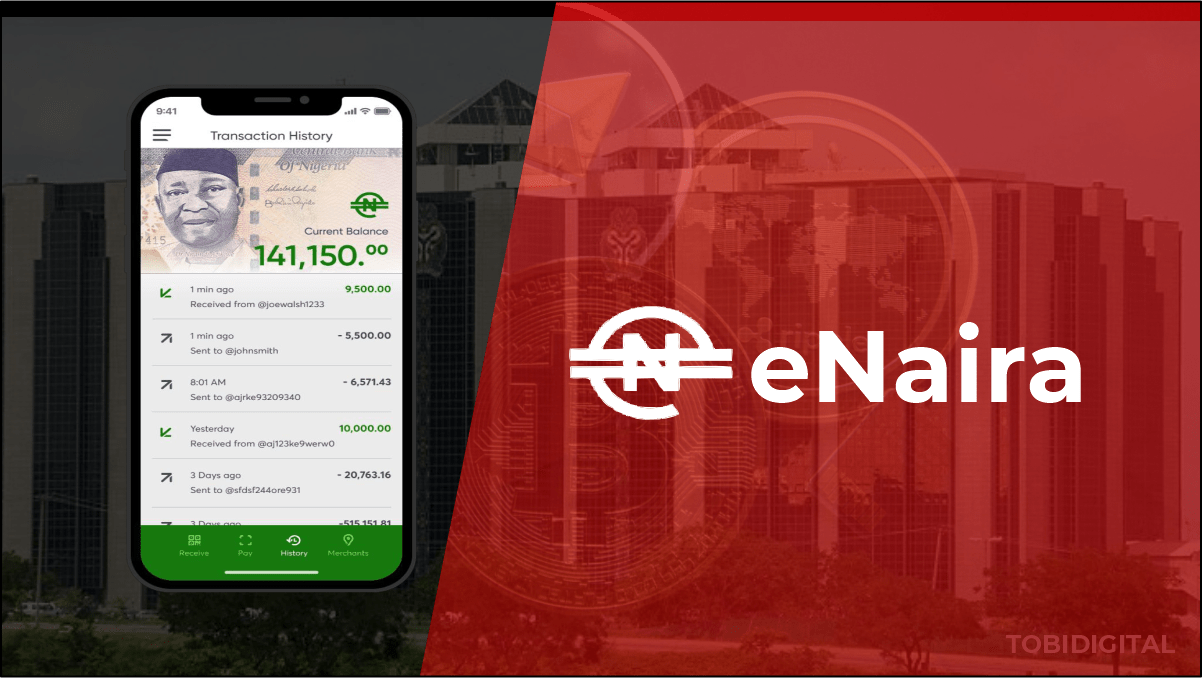

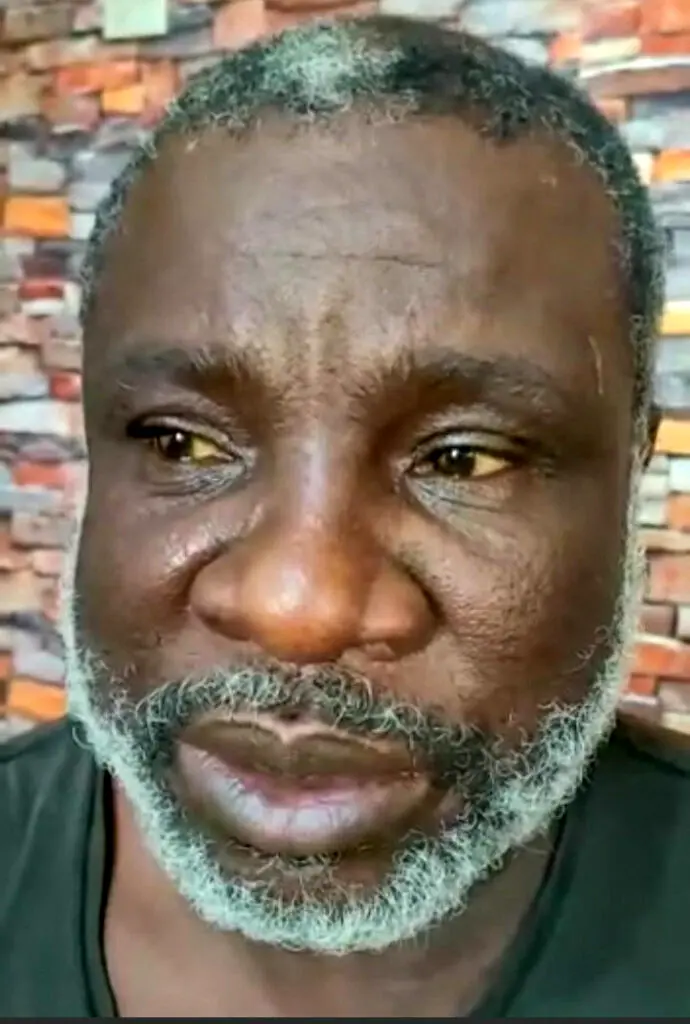

Mr Godwin Emefiele, Governor, Central Bank of Nigeria (CBN), says that in less than four weeks, the eNaira app had witnessed almost 600,000 downloads since its launch in October.

Emefiele made the disclosure at the 56th Chartered Institute of Bankers of Nigeria (CIBN) Annual Bankers Dinner, on Friday night at the Federal Palace Hotel, Lagos.

“In less than 4 weeks since its launch, almost 600,000 downloads of the e-Naira application have taken place.

Join our WhatsApp Channel“Efforts are ongoing to encourage faster adoption of the e-Naira by Nigerians who do not have smartphones.

“The support of the financial industry will be critical in the ongoing deployment of the e-Naira and efforts are ongoing to encourage continued partnership between the CBN and stakeholders in the financial industry,’’ he said.

READ ALSO: eNaira Wallet Records 488,000 Downloads In 160 Countries

The CBN governor noted that building a robust payment system that would provide cheap, efficient, and faster means of conducting payments for most Nigerians have always been the focus of the apex bank.

According to him, “the growing pace of digitization globally, makes it essential that we leverage digital channels in fulfilling this objective”.

Emefiele said that total transaction volumes using digital channels more than doubled between 2018 and 2020, as volumes rose from 1.3 billion to over 3.3 billion financial transactions in 2020.

He said that Digital payment channels also helped to support continued conduct of business activities during the lockdown.

He said the banking sector robust payment system has continued to evolve towards meeting the needs of households and businesses in Nigeria, reflective of the confidence in our payment system, indicating that between 2015 and September 2021, about US$900 million has been invested in firms run by Nigerian founders.

“Notwithstanding these gains, close to 36 per cent of adult Nigerians do not have access to financial services.

“Improving access to finance for individuals and businesses through digital channels can help to improve financial inclusion, lower the cost of transactions, and increase the flow of credit to households and businesses,’’ he stressed.