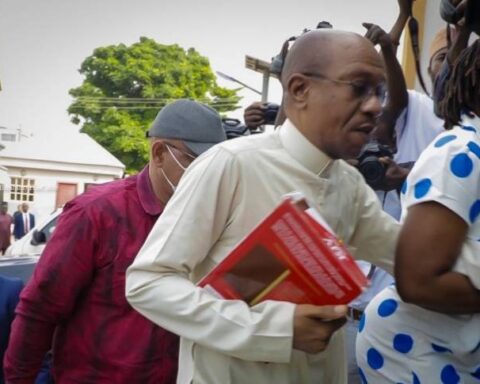

Operatives from the Economic and Financial Crimes Commission (EFCC) reportedly descended on Bureau De Change (BDC) operators in Wuse Zone 4 market on Tuesday as the naira depreciated to N1,416 to a dollar.

Witnesses narrated scenes of resistance, gunfire, and damaged EFCC vehicles during the raid.

Join our WhatsApp ChannelA trader, speaking anonymously, expressed frustration, stating, “Yesterday they arrested traders, but today’s operation was too strong.” Another cautioned that such raids could escalate to fatalities, emphasizing, “If this thing continues like this, that means they would kill people because if they try to arrest next time, nobody would agree.”

The EFCC’s crackdown aims to stabilize the naira amidst its free fall. Recent weeks saw multiple arrests of suspected currency speculators and BDC operators in the capital city. Despite these efforts, the naira’s value remains volatile.

In the market, traders noted buying the dollar at N1,400 and selling at N1,425, with a thin profit margin of N25. However, the naira depreciated further, hitting N1,416/$ at the official market. This represents a 4.4% decrease or N62 from the previous rate.

Market participants voiced concerns over fluctuating rates, with one trader, Malam Yahu, lamenting, “The naira is not stable at all, and that’s why we are even skeptical about buying now.” Such instability affects traders’ ability to predict market movements and make informed decisions.

READ ALSO: Why Nigerian Govt Plans To Ban Naira From Crypto Trading Platforms

A trader who confirmed the incident warned that a continued raid by the anti-corruption body might lead to killings.

The trader who also pleaded anonymity said, “If this thing continues like this, that means they would kill people because if they try to arrest next time, nobody would agree and another person would gather together so that nobody would be taken.

“That was happened today. People are now turning because all they do after arrest is to collect money from us. Nothing else is done. They are frustrating to use.’

Data from the FMDQ exchange securities revealed a surge in the volume of dollars supplied, indicating heightened market activity amidst the turmoil. However, this surge coincides with a period of significant depreciation, raising questions about market dynamics and regulatory effectiveness.

The EFCC’s actions underscore the government’s determination to combat currency speculation and stabilize the economy. However, the ongoing volatility in the naira reflects deeper structural challenges that require holistic solutions beyond law enforcement.

As the market grapples with uncertainty, traders and regulators alike face the daunting task of restoring stability and confidence in the Nigerian economy. The outcome of these efforts will not only shape the trajectory of the naira but also impact the livelihoods of millions of Nigerians dependent on a stable currency for their economic well-being