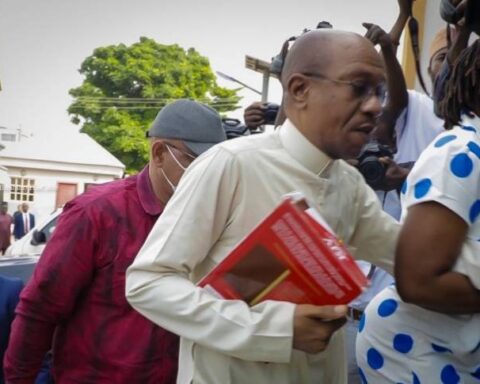

The Economic and Financial Crimes Commission (EFCC) on Monday conducted a surprise raid on Bureau De Change (BDC) operators in the Wuse Zone 4 area of Abuja, arresting an unspecified number of traders as the naira further dips to N1,419/$1.

This action is a component of the EFCC’s and the CBN’s continuous efforts to stabilise the currency rate and increase foreign exchange liquidity.

Join our WhatsApp ChannelThe raid, according to BDC operators, generated havoc and terror in the neighbourhood, resulting in the arrest of some vendors and the forced evacuation of others. Under the condition of anonymity, the traders stated that they were still attempting to raise N30,000 to N50,000 in order to release individuals who had been arrested on Friday, just for the EFCC to carry out another raid on Monday.

“EFCC just raided the market, arresting many operators,” one of the traders remarked. They also followed some people to their offices after arresting other people they saw on the street.

We are still looking for N30,000 or N50,000 to bail those arrested on Friday, yet they came again today.”

The naira started the week poorly despite these attempts, falling N58 or 4.3% versus the US dollar and closing at N1,419.11/$ on Monday. A strong demand for US dollars is shown by this fall.

READ ALSO: Naira Strengthens To 1,275/$ at Parallel market, Senate Calls For Efforts To Sustain Stability

The naira fell in value at the official market on Monday, falling from N1,361 on Friday to N1,419 on Monday, a loss of N58 or 4.3%. While the intraday low increased to N1,060 on Monday from N1,051 per dollar quoted on Friday, the intraday high closed at N1,451 on Monday from N1,410 per dollar on Friday.

The popular Zone 4 market’s currency dealers reported that they sold dollars for N1,340 each, up from N1,275 over the weekend. A trader, Abubakar Taura, said he bought the dollar at the rate of N1,305 and sold at N1,340, leaving a profit margin of N25.

Despite the EFCC and CBN’s efforts to stabilise the exchange rate, the fall of the naira portends a difficult week ahead. The naira steadily increased in value over 14 days, from N1,470/$1 on March 25 to N1,120/$1 on April 19. This was followed by a six-day depreciation, which saw a decrease of N310, or 21.68%, to N1,430/$1 on April 26.

By the end of the week, the naira had recovered by 2.14%, and by Monday, it had gained an extra 3.70%, reversing the negative trend. The naira closed at N1,339.23/$1 on April 26 after declining by N169.24, or 12.64%, from N1,169.99/$1 on April 19. Nevertheless, the devaluation of the naira in the official market is still ongoing.

To resolve the issues affecting the naira, the EFCC, and CBN must continue their efforts to stabilise the exchange rate and increase foreign liquidity. One of these initiatives is the raid on BDC operators, which aims to stop currency theft and speculation. Nonetheless, the devaluation of the naira persists, pointing to a complicated issue that calls for persistent efforts to resolve.