The Central Bank of Nigeria (CBN) has established a dedicated department to manage crude oil sales transactions previously handled by the Nigerian National Petroleum Company Limited (NNPCL).

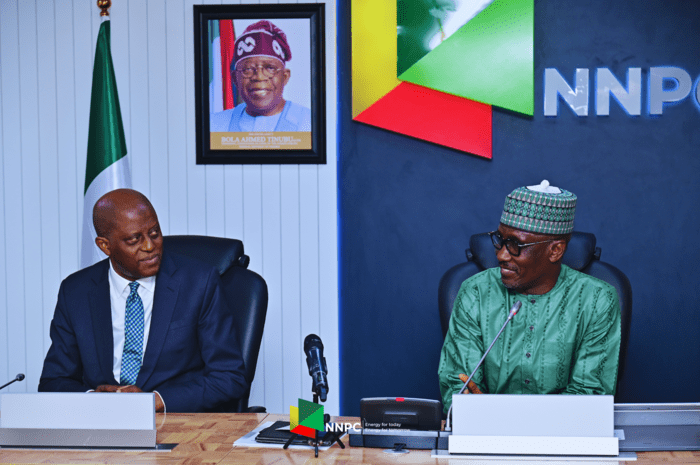

Mele Kyari, the Group Chief Executive Officer of NNPCL, announced on Thursday, emphasizing the decision’s importance.

Join our WhatsApp ChannelAddressing reporters in Abuja, Kyari welcomed the move, highlighting its alignment with the directives of NNPCL’s Board of Directors and the need for enhanced collaboration with the CBN. He stated, “We are a very huge company… We are also happy that the CBN has created a robust digital platform for our transactions.”

Olayemi Cardoso, the Governor of CBN, expressed confidence in the bank’s ability to undertake this significant responsibility.

READ ALSO: NNPCL, TotalEnergies Celebrate As Production Begins On Akpo West Oil Field

He assured stakeholders that internal processes had been revamped to accommodate the additional workload effectively.

The decision to transfer NNPCL’s oil sales transactions to CBN stirred varied reactions. While some commended the move for potential efficiency gains, others, like presidential candidate Atiku Abubakar, criticized it as illegal and a breach of NNPCL’s operational independence.

Atiku argued, “The action is not legal in its application… Mr. President has wrested control of the finances of NNPCL and donated the same to the Federal Ministry of Finance and CBN.”

He emphasized the need for transparency and adherence to due process in public administration.

Amidst these developments, NNPCL moved to allay fears of an impending hike in petrol prices, urging Nigerians to disregard rumors and assuring them of ample fuel availability nationwide. Chief Corporate Communications Officer Olufemi Soneye stated, “There are no plans for an upward review of the PMS price.”

The establishment of a dedicated department at CBN marks a significant shift in Nigeria’s oil industry dynamics, signaling closer collaboration between key stakeholders while also raising concerns about potential implications for the autonomy of state-owned enterprises.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.