The Economic and Financial Crimes Commission (EFCC) is joining forces with the Nigeria Deposit Insurance Corporation (NDIC) to investigate and prosecute individuals responsible for potential bank failures stemming from financial misconduct.

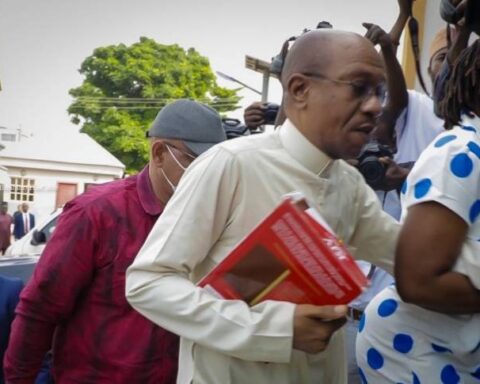

The focus of this collaborative effort is the high-profile case involving Tuoyo Omatsuli, the former Executive Director of Projects at the Niger Delta Development Commission (NDDC), accused of orchestrating a N3.6 billion fraud between August 2014 and September 2015 in Lagos.

Join our WhatsApp ChannelThe charges allege a sophisticated conspiracy to launder funds through illegal activities, including corruption and gratification.

In a court hearing, the EFCC intensified its pursuit of justice, seeking a warrant for Omatsuli’s arrest after he was absent, claiming an ongoing appeal before the Supreme Court.

READ ALSO: Forex Scandal: EFCC Probes $347bn Allocations To Foreign Companies In Nigeria

The defense argued that their client was unaware of the proceedings, emphasizing a lack of representation during the last session. However, the EFCC countered, asserting that the appeal should not impede proceedings at the Federal High Court.

Despite the initial discharge of Omatsuli by retired Justice Saliu Saidu in November 2020, the Court of Appeal overturned the decision in April 2022, mandating Omatsuli to enter into his defense. The legal saga emphasizes the challenges and complexities involved in prosecuting financial crimes, with proceedings extending from the initial trial to the appellate stage.

The case, set to resume on March 22, 2024, will involve re-arraignment and further trial proceedings. The EFCC’s unwavering commitment to holding individuals accountable for financial misconduct, particularly within public office, underscores the broader efforts to combat corruption in government agencies.

This collaborative investigation between the NDIC and EFCC signifies a proactive approach to safeguarding the financial sector, aiming to prevent potential bank failures linked to fraudulent activities. The outcome of this case will likely set a precedent for future prosecutions, sending a strong message against corruption and financial wrongdoing in Nigeria’s public and banking spheres.