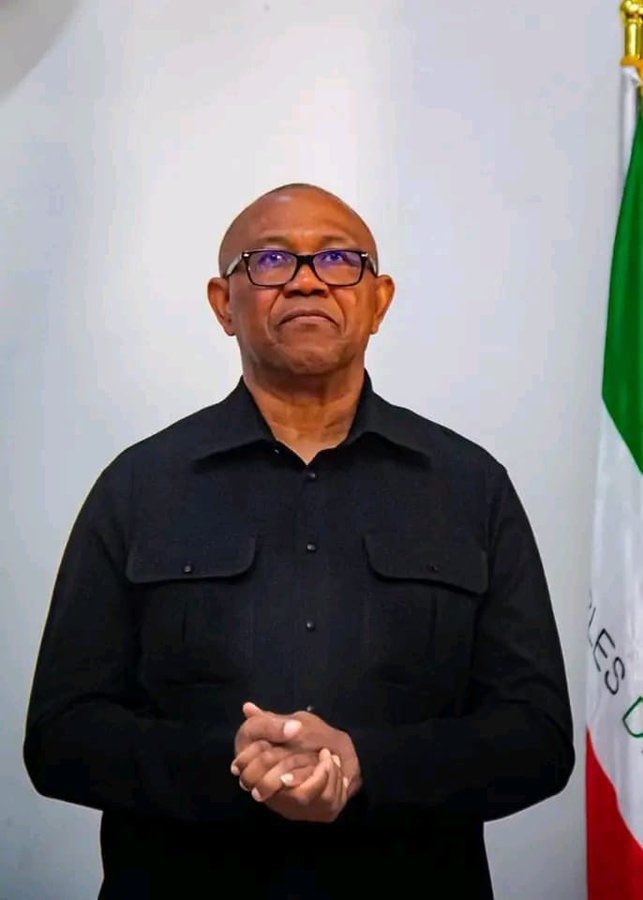

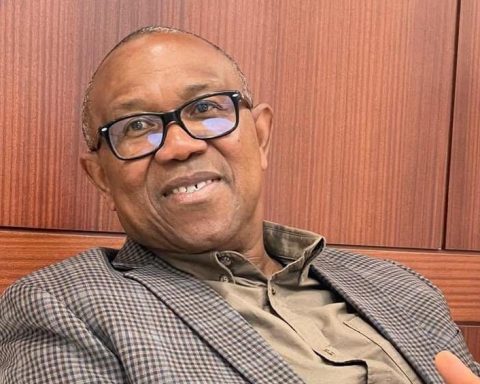

Presidential candidate of the Labour Party in the 2023 general elections, Mr Peter Obi, has decried the continued shutdown of operations by foreign companies in Nigeria, warning that such development has detrimental effect on the economy.

Obi stated this while reacting to the news of the exit of Jubilee Syringe Manufacturing (JSM), the largest syringe manufacturer in Africa, located in Awa, Onna Local Government Area of Akwa Ibom State Nigeria.

Join our WhatsApp ChannelIn a statement posted on his X handle on Friday, Obi said this “is yet another painful development on our national journey.

“This very sad development, where multinational companies continue to exit Nigeria, should worry every concerned Nigerian. This ugly development contrasts the Government’s claim that the regime is attracting investors,” Obi stated.

Just like GlaxoSmithKline (GSK), Procter and Gamble (P&G) and others, Jubilee Syringe Manufacturing earlier in the week announced its intention of restructuring business operations in Nigeria which involves shutting down in-country production due to harsh economic realities.

READ ALSO: GSK’s Exit From Nigeria Will Push Over 1000 Out Of Job – Obi

The former Anambra State governor lamented that the exit of these foreign firms and the closure of the domestic ones would have grave implications on the national economy

He particularly asserted that the exit of both GSK and JSM, whose operations significantly impacted on national health, will further snuff life out of the country’s health sector.

“Aside the resulting jobs losses, its cost effects on the products they produce, worsening poverty index, capital flight, and loss of human assets, I am particularly concerned about the negative impacts of such exits on our health sector. The combined effect of the exit of GSK, a giant pharmaceutical company, and now Jubilee Syringe Manufacturing (JSM) whose operations directly impacted on our national health, will further stifle our health sector already on life support.”

He maintained that these developments were due to poor management of the economy.

READ ALSO: Why Foreign Investment Continues To Decline In Nigeria – KPMG

He advised the Federal Government to address the disturbing trend to not only discourage more businesss shutdowns in Nigeria but also “encourage a high inflow of foreign direct investment and local investment in the nation. This they can do by building a conducive environment that will encourage productivity and business growth.”

“As I have consistently maintained, the New Nigeria, we all look forward to, will focus on moving the nation from consumption to production, and from unproductivity to productivity. This will attract foreign and local investors, create jobs, and foster productivity and prosperity in the nation,” Obi stated.

Global audit, tax, and advisory services firm, KPMG, had while reacting to the report released by the National Bureau of Statistics (NBS) which showed that there was a decline of capital importation in Q3 2023, said it was due to continuing negative market sentiments against the country.

KPMG partly attributed the reason for waning investors’ interest to news of exit of some big foreign companies that have operated in the country for many years.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

I simply enjoy the useful details you provide in your writings.