The Nigerian naira experienced a depreciation, closing at N809.02 per US dollar at the official market on Monday, the 6 of November 2023. This marked a 4.06% increase from the N776.14/$1 rate recorded just three days earlier, on Friday, 3rd November.

The forex market was a whirlwind on this particular day, with an intraday high of N1100/$1 and an intraday low of N720.50/$1. This fluctuation represented a spread of N379.50/$1, leaving many market participants scratching their heads.

Join our WhatsApp ChannelData sourced from the official NAFEM window revealed that the forex turnover at the end of the trading day stood at $87.65 million, marking an 11.30% decrease compared to the previous day’s trading volume.

READ ALSO: Naira Trades Below N900/$1 At P2P, Spectators Lament

In contrast, the unofficial black market saw a different story. The exchange rate there appreciated by 16.18%, quoting at N1020/$1. Peer-to-peer traders took it a step further, quoting around N1063.50/$1. This difference between official and unofficial rates has left many Nigerians bewildered, as they grapple with the varying exchange rates for their daily transactions.

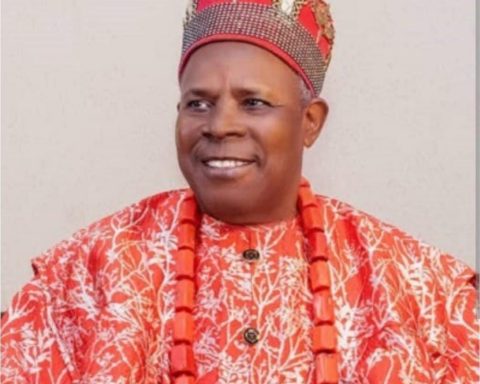

The Association of Bureau de Change Operators of Nigeria (ABCON) is urging caution amidst this economic turbulence. The President of ABCON, Aminu Gwadabe, warned speculators against playing with the naira’s fate. He also highlighted the Central Bank of Nigeria’s (CBN) intention to take strong measures against those who speculate against the national currency.

Gwadabe explained, “What is happening in the market and the continuous naira rebounds are the manifestations of the CBN’s double-edged sword measures of dollar liquidity injection and naira mopping through the instrumentality of interest rate hikes. It is a good development as it is the greatest risk to speculate, hoard, and substitute naira for other currencies.”

The naira had been on a rollercoaster this year, but it appeared to stabilize after the CBN initiated the clearance of the forex demand backlog in banks. “As we continue to observe developments, there is a need for caution when attacking the naira, as it appears that the CBN has the arsenal and logic to continue to enshrine the success recorded,” ABCON added.

The association also pointed out a shift from panic buying to panic selling and called upon the CBN to provide more clarity and implement recommendations that would allow BDCs (Bureau de Change) to participate more actively in the foreign exchange market. This, they argued, would help meet the needs of the critical retail end sector and contribute to the overall stability of the forex market.

“The BDCs are necessary for the demand measures of the apex bank transaction monitoring mechanism and client utilization, with the aim of correcting and moderating potential disparities,” Gwadabe emphasized.

The naira’s fate remains uncertain, but it’s evident that the CBN’s policies and actions play a pivotal role in shaping its trajectory.