The Director General of the Manufacturers Association of Nigeria (MAN) has called on the Nigerian government to focus on crafting policies that encourage domestic production to increase the contribution of the manufacturing sector to the nation’s GDP.

He stated this while reacting to the recent introduction of a four per cent Free on Board (FoB) levy on imports by the Nigeria Customs Service (NCS).

Join our WhatsApp ChannelThe levy, which was announced by the Comptroller General of the NCS, Adewale Adeniyi, in July, took effect on 4 August 2025.

This levy, which is applied to the total value of goods before shipment, has sparked significant concern over its potential to increase production costs and exacerbate inflation.

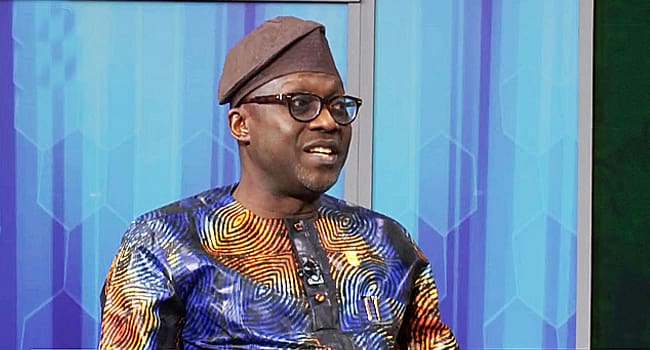

In an interview with Arise News Morning Show, Ajayi-Kadir said charging four per cent FoB levy will significantly impact the cost structure for manufacturers and also set them apart from other comparable economies, particularly within the West African sub-region.

He said there are duties for raw materials, spare parts and machines set by the World Customs Organisation, which they have been complying with, but the new FoB charge is an additional burden.

Earlier, MAN had issued a statement calling for the suspension of the FoB levy over its implications on the cost of operations and the potential impact on consumers.

The association urged the government to return to the previous one per cent Comprehensive Import Supervision Scheme (CISS) levy and a 7 per cent cost for collection, while it embarks on a proper impact assessment and inclusive consultations with stakeholders to determine a more appropriate charge level and develop business-friendly guidelines.

The MAN DG said the FoB has to be comparable with other neigbouring West African countries such as Senegal, Ghana and Côte d’Ivoire.

According to him, the FOB charge of these countries is between 0.5 per cent and one per cent. “Taking ours to 4% far out-classes the 1% CIS and the 7% cost of collection that customs previously collected,” Ajayi-Kadir stated.

READ ALSO: Concerns As New Customs Licensing Fee Jumps 20-fold

Speaking on revenue generation, he said when customs was collecting one per cent CIS and seven per cent cost of collection, it was able to exceed its target for 2024. “There’s really no imperative to increase earnings by custom,” it added.

He said the government should focus on trade facilitation and reduce the cost of imports.

While commending the federal government for ongoing economic reforms, he reiterated his warning that the introduction of the levy would escalate costs and worsen inflation that is already on a downward trend.

“So, we are saying that customs should kindly consider the overall impact on the economy, on the manufacturer, on the consumers, on the taxes we are going to pay to the government, because if we reduce our capacity utilization and profitability, the government is going to be impacted,” he stated.