Value Added Tax (VAT) in Nigeria is a type of consumption tax imposed on the value added to goods and services at each stage of production and distribution.

Introduced in 1993 to replace Sales Tax, VAT which is administered by the Federal Inland Revenue Service (FIRS), has undergone reviews. It was increased from 5 per cent to 7.5 per cent in 2020 and now the Presidential Committee on Fiscal Policy and Tax Reforms has recommended that the Federal Government should further increase it to 10 per cent.

Join our WhatsApp ChannelVAT collection in Nigeria has continued to record significant improvements over the years.

According to recent report released by the National Bureau of Statistics (NBS), Value Added Tax (VAT) for the second quarter (Q2) of 2024 was N1.56 trillion. This reflects a growth rate of 9.11 per cent on a quarter-on-quarter basis from N1.43 trillion in Q1 2024.

The NBS report indicated that local payments recorded were N792.58 billion; Foreign VAT Payments amounted to N395.74 billion, while import VAT contributed N372.95 billion in Q2 2024.

On a year-on-year basis, VAT collections in Q2 2024 increased by 99.82 per cent from Q2 2023.

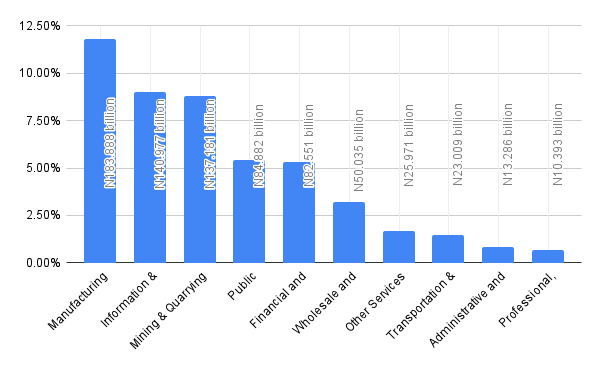

In this article, we shall look at the 10 sectors with highest VAT contributions in the second quarter of 2024.

1. Manufacturing

The manufacturing sector retained its status of highest contributor to VAT in the country in Q2 2024. The sector recorded N183.888 billion which is 11.78 per cent of the total VAT in the period under review. When compared with N174.174 billion recorded by the sector in the previous quarter, it reflects an increase of 3.8 per cent.

This increase in VAT collection comes at a time the manufacturing sector in the country is faced with numerous challenges such as energy costs, infrastructure, access to raw materials, high exchange rate, and general cost of production among others.

2. Information and Communication

The Information and Communication sector came second in terms of sector contribution to VAT in Q2 2024 with N140.977 billion which is 9.02 per cent. The sector recorded N115.546 billion in Q1 2024 which means there was an increase of 21.85 per cent. While it saw a decrease in Q1, there was an increase this time. The sector has remained one of the most economically vibrant sectors in Nigeria’s economy in recent years, largely driven by activities in the telecommunications.

READ ALSO: Nigeria: Top 10 Performing Sectors By VAT Contribution In Q1 2024

3. Mining and Quarrying

Mining and Quarrying also retained its third position as seen in Q1. With a total of N137.181 billion, the mining and quarrying sector had 8.79 per cent of the overall VAT contributions in Q2 2024. The sector also saw an increase of 34.18 per cent from N102.237 billion in Q1 2024.

4. Public Administration and Defence, Compulsory Social Security

Public administration and defence, compulsory social security sector moved to the fourth position on the chart of 10 sectors with highest VAT contributions. The sector was 5th highest in Q1 but this time, displaced finance and insurance. The Public administration and defence, compulsory social security sector recorded N84.882 billion which is 5.43 per cent of the total VAT in Q2 2024. When compared to the previous quarter, it increased by 51.2 per cent from N56.123 billion in Q1 2024.

5. Financial and Insurance Activities

The Financial and Insurance Activities sector dropped to the fifth rank in the chart of 10 sectors with highest VAT contributions in 2024. The NBS data show that the sector recorded N82.551 billion in Q2 2024 which is 5.3 per cent of the total VAT contributions in the quarter. Despite being displaced in rank, the sector however, saw a growth of 25.79 per cent when compared to the Q1 2024 which is N65.624 billion.

6. Wholesale and Retail Trade, Repair of Motor Vehicles and Motorcycles

This sector which encompasses businesses that the into wholesale and retail trade, repair of motor vehicles and motorcycles had N50.035 billion which is 3.20 per cent. In terms of quarter-on-quarter growth, the sector saw 11.88 per cent increase from N44.721 billion in Q1 2024.

7. Other Services Activities

This sector classified as other sector activities, recorded N25.971 billion in Q2 2024 which is 1.66 per cent of the total VAT collections in the quarter under review. In terms of quarter-on-quarter, the sector saw a growth of 24.70 per cent from 20.827 billion in the previous quarter.

8. Transportation and Storage

The Transportation and storage sector which takes the eightieth position in the chart of top 10 sectors that paid the highest VAT, had N23.009 billion which is 1.47 per cent. The sector saw a drop of 4.33 percent when compared to N24.051 billion in Q1 2024.

9. Administrative and Support Service Activities

The Administrative and support service activities sector moved to take the ninth place in the chart. This sector recorded N13.286 billion which is 0.85 per cent. In terms of QnQ, it increased by 33.63 per cent from N9.942 billion in Q1 2024.

10. Professional, Scientific and Technical Activities

The Professional, scientific and technical activities which came tenth in the chart, recorded N10.393 billion which is 0.67 per cent contribution of the sector. On QnQ basis, the sector recorded an increase of 7.99 per cent from N9.624 billion in Q1 2024.

The recent proposal by the Federal Government to increase VAT from 7.5 per cent to 10 per cent has generated reactions from many Nigerians who kicked against. They argue that given the level of economic hardship in the country, increasing the VAT adds to the burden faced by the citizens.

However, some have also expressed support for the increasing stating that it is a right step towards boosting revenue of the government to reduce borrowing.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

Follow Us